University Circle employers will offer grants to attract residents

Employers, foundations to offer incentives to attract residents

Sunday, December

9, 2007

Tom Breckenridge

Plain Dealer Reporter |

Community leaders want big growth in University

Circle to mean big opportunities for struggling nearby neighborhoods.

So the circle's largest employers will join local foundations in offering $5

million in grants and forgivable loans over the next five years to employees who

buy, rent or fix up dwellings in the area. It's part of a strategy called the

Greater University Circle Initiative, led by the Cleveland Foundation.

The effort has the Cleveland Clinic, Case Western Reserve University and

University Hospitals teaming with City Hall and other nonprofits in the circle

to boost the stodgy district, and its surrounding neighborhoods.

For most of the decade, University Circle has been booming with construction

while downtown has stagnated. Since 2000, more than $2 billion in projects have

been built or are under way.

But just a short drive from the bustling construction sites are streets where

blight, vacancy and foreclosure are common.

It's time to leverage University Circle's growth, officials say. Some 40,000

people work in the area, and thousands more are expected in the next decade. The

idea is to dangle financial incentives, drawing some of those workers to

neighborhoods that sorely need new wealth.

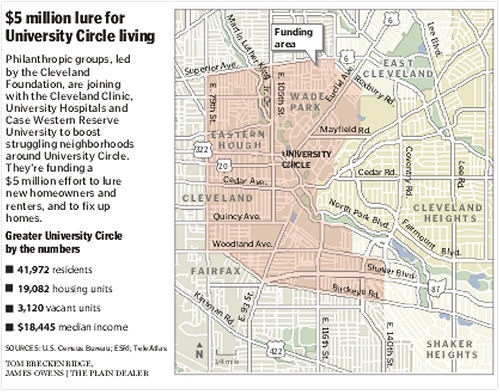

Areas targeted under the $5 million program include parts of Glenville, Hough,

Fairfax and Buckeye-Shaker and a chunk of East Cleveland.

"You can't have an employment growth center without quality neighbor-hoods

around it," said Chris Ronayne, president of University Circle Inc. and former

planning director for Cleveland. "The fates of [these institutions] and the

neighborhoods are tied. You need to attract people, and at the same time, you

need to fix up."

The $5 million program will be launched next spring, Cleveland Foundation

officials said.

They have committed $1 million over the five years. The George Gund Foundation

and several other philanthropies are expected to chip in $1.5 million more.

The foundations will funnel their money to employees of University Circle-area

nonprofits, excluding the Clinic, UH and Case.

Those three institutions are expected to contribute $2.5 million and will set

program criteria for their own employees.

The $5 million should spur about 800 deals, most of them for mortgage

assistance, Cleveland Foundation officials said.

The foundations are eager to work with moderate- to low-income applicants. One

of the goals "is to create wealth for working families," said Lillian Kuri,

director of special projects for the Cleveland Foundation.

Applicants would get up to $10,000 to help with a down payment and closing

costs. The loan is forgiven after five years.

Existing homeowners would get up to $4,000 to match their costs for home

repairs. New apartment dwellers would qualify for a one-month reimbursement on

rent.

All deals will be handled by the Fairfax Renaissance Development Corp.

Chris Warren, head of regional development for Mayor Frank Jackson, said the

program can help build demand for hundreds of new dwellings planned in and

around University Circle.

"The opportunity to capture people who don't have to brave a commute or spend

money on gas, and who want to be near a cool place to live, is not far-fetched

at all," Warren said.

The program will attract high interest, if similar mortgage-assistance programs

are an indication.

Case spurred 108 home purchases in 2004 and 2005

by offering a two-tiered program of grants -- up to $10,000 to employees who

moved to the city and up to $15,000 for employees who moved into one of four

wards that include University Circle, said Carolyn Gregory, Case's vice

president of human resources.

All told, Case invested $500,000 in the program, Gregory said. Thirty-two of the

deals were in the University Circle area.

Case employees "bought millions of dollars worth of homes with this money," she

said.

For the last decade, Fairfax has run a modest down-payment assistance program

for employees of the Clinic and UH.

About 120 employees received forgivable loans of $2,000 for a move into the

city, said Vickie Johnson, executive director of the Fairfax development

corporation.

The loan recipients' average income was $30,000, Fairfax reported.

"If it works on a small scale, it has to be successful on a large scale,"

Johnson said.

The mortgage-assistance plan is part of a strategy playing out in big cities

across the nation. Planners and civic leaders are parlaying the wealth and

resources of anchor institutions, like universities and hospitals, into

neighborhood redevelopment.

The Greater University Circle initiative is modeled on the success that the

University of Pennsylvania had in West Philadelphia.

The university invested millions of dollars in programs for home repair and

mortgage assistance, said Lucy Kerman, a former Penn official.

The incentives helped draw 400 Penn employees to the area, which is smaller and

more compact than University Circle, said Kerman.

"It's not that the anchors have to intervene with every homeowner," Kurman said.

"They have to try and tip the market by bringing a core of pioneers into the

neighborhood."

The strategy worked -- almost too well. Home values climbed, drawing a

higher-income market. Some longtime residents faced higher property taxes and

rents, the side effect of gentrification.

Still, the neighborhood has maintained its diversity and mix of incomes, Kurman

said.

Kuri, of the Cleveland Foundation, doesn't believe the mortgage-aid program will

open the door to gentrification around University Circle.

She expects most applicants will be mid- to low-income. That's because 75

percent of employees at the Clinic, UH and Case earn $50,000 a year or less, she

said.

"This is in no way geared to gentrification," Kuri said. "It's a strategy that

is real revitalization and that is sustainable."

One of the more remarkable facets of the $5 million program -- and ongoing

strategies to boost University Circle living -- is the collaboration,

particularly among Case, the Clinic and UH, observers said. The latter two are

sharp competitors in the health-care market.

Thomas Zenty, chief executive of UH, said partnering with other big employers is

important.

"This program gives everybody a chance to own, renovate or live in the circle,"

Zenty said. "We think it's a great thing for Cleveland."

To reach this Plain Dealer reporter:

tbreckenridge@plaind.com, 216-999-4695

The $5 million program will be launched next spring, Cleveland Foundation

officials said.

They have committed $1 million over the five years. The George Gund Foundation

and several other philanthropies are expected to chip in $1.5 million more.

The foundations will funnel their money to employees of University Circle-area

nonprofits, excluding the Clinic, UH and Case.

Those three institutions are expected to contribute $2.5 million and will set

program criteria for their own employees.

The $5 million should spur about 800 deals, most of them for mortgage

assistance, Cleveland Foundation officials said.

The foundations are eager to work with moderate- to low-income applicants. One

of the goals "is to create wealth for working families," said Lillian Kuri,

director of special projects for the Cleveland Foundation.

Applicants would get up to $10,000 to help with a down payment and closing

costs. The loan is forgiven after five years.

Existing homeowners would get up to $4,000 to match their costs for home

repairs. New apartment dwellers would qualify for a one-month reimbursement on

rent.

All deals will be handled by the Fairfax Renaissance Development Corp.

Chris Warren, head of regional development for Mayor Frank Jackson, said the

program can help build demand for hundreds of new dwellings planned in and

around University Circle.

"The opportunity to capture people who don't have to brave a commute or spend

money on gas, and who want to be near a cool place to live, is not far-fetched

at all," Warren said.

The program will attract high interest, if similar mortgage-assistance programs

are an indication.

Case spurred 108 home purchases in 2004 and 2005 by offering a two-tiered

program of grants -- up to $10,000 to employees who moved to the city and up to

$15,000 for employees who moved into one of four wards that include University

Circle, said Carolyn Gregory, Case's vice president of human resources.

All told, Case invested $500,000 in the program, Gregory said. Thirty-two of the

deals were in the University Circle area.

Case employees "bought millions of dollars worth of homes with this money," she

said.

For the last decade, Fairfax has run a modest down-payment assistance program

for employees of the Clinic and UH.

About 120 employees received forgivable loans of $2,000 for a move into the

city, said Vickie Johnson, executive director of the Fairfax development

corporation.

The loan recipients' average income was $30,000, Fairfax reported.

"If it works on a small scale, it has to be successful on a large scale,"

Johnson said.

The mortgage-assistance plan is part of a strategy playing out in big cities

across the nation. Planners and civic leaders are parlaying the wealth and

resources of anchor institutions, like universities and hospitals, into

neighborhood redevelopment.

The Greater University Circle initiative is modeled on the success that the

University of Pennsylvania had in West Philadelphia.

The university invested millions of dollars in programs for home repair and

mortgage assistance, said Lucy Kerman, a former Penn official.

The incentives helped draw 400 Penn employees to the area, which is smaller and

more compact than University Circle, said Kerman.

"It's not that the anchors have to intervene with every homeowner," Kurman said.

"They have to try and tip the market by bringing a core of pioneers into the

neighborhood."

The strategy worked -- almost too well. Home values climbed, drawing a

higher-income market. Some longtime residents faced higher property taxes and

rents, the side effect of gentrification.

Still, the neighborhood has maintained its diversity and mix of incomes, Kurman

said.

Kuri, of the Cleveland Foundation, doesn't believe the mortgage-aid program will

open the door to gentrification around University Circle.

She expects most applicants will be mid- to low-income. That's because 75

percent of employees at the Clinic, UH and Case earn $50,000 a year or less, she

said.

"This is in no way geared to gentrification," Kuri said. "It's a strategy that

is real revitalization and that is sustainable."

One of the more remarkable facets of the $5 million program -- and ongoing

strategies to boost University Circle living -- is the collaboration,

particularly among Case, the Clinic and UH, observers said. The latter two are

sharp competitors in the health-care market.

Thomas Zenty, chief executive of UH, said partnering with other big employers is

important.

"This program gives everybody a chance to own, renovate or live in the circle,"

Zenty said. "We think it's a great thing for Cleveland."

To reach this Plain Dealer reporter: tbreckenridge@plaind.com, 216-999-4695

© 2008 The Plain Dealer

© 2008 cleveland.com All Rights Reserved.

To read this

on the web pages of the Plain Dealer,

click here.

Applying the

Fair Use Doctrine, we

have saved this story on our web space because the

PD does not keep the full text of stories online

indefinitely.